Social Security might feel like something for your grandparents … or maybe you are at the point where you are ready to retire and enjoy the fruits of your labor. Perhaps you feel like you have put in your time and a well-earned retirement is just around the corner. Whatever your situation, understanding Social Security is a step well worth taking toward claiming what is rightfully yours.

Social Security benefits are based on your lifetime earnings, with the SSA using your 35 highest-earning years to calculate your benefit. The income you pay Social Security taxes on is capped each year, so the more you earn (up to the limit), the more you pay in — and the higher your potential retirement benefit.

Do You Qualify?

- Social Security Number: It may seem obvious, but you need a valid SSN,so your earnings are properly tracked over your lifetime;

- Citizenship/Residency: You must be a US citizen or a lawful non-citizen still living in the US; and

- Work Credits: You must have worked in the US for about ten (10) years, and paid FICA out of your reported earned income.

When Can I Start? You can apply for Social Security retirement benefits as early as age 62.

Timing Matters

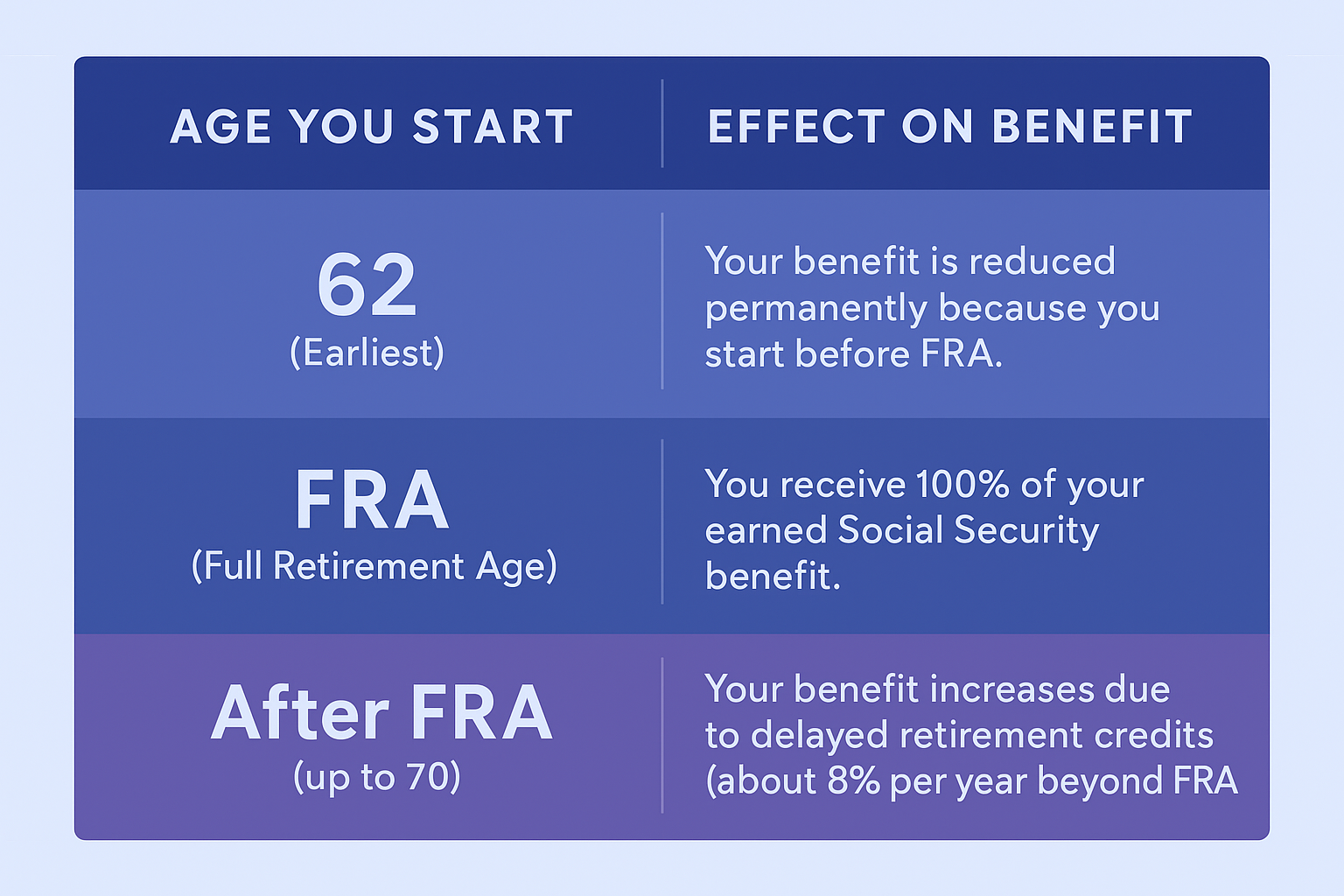

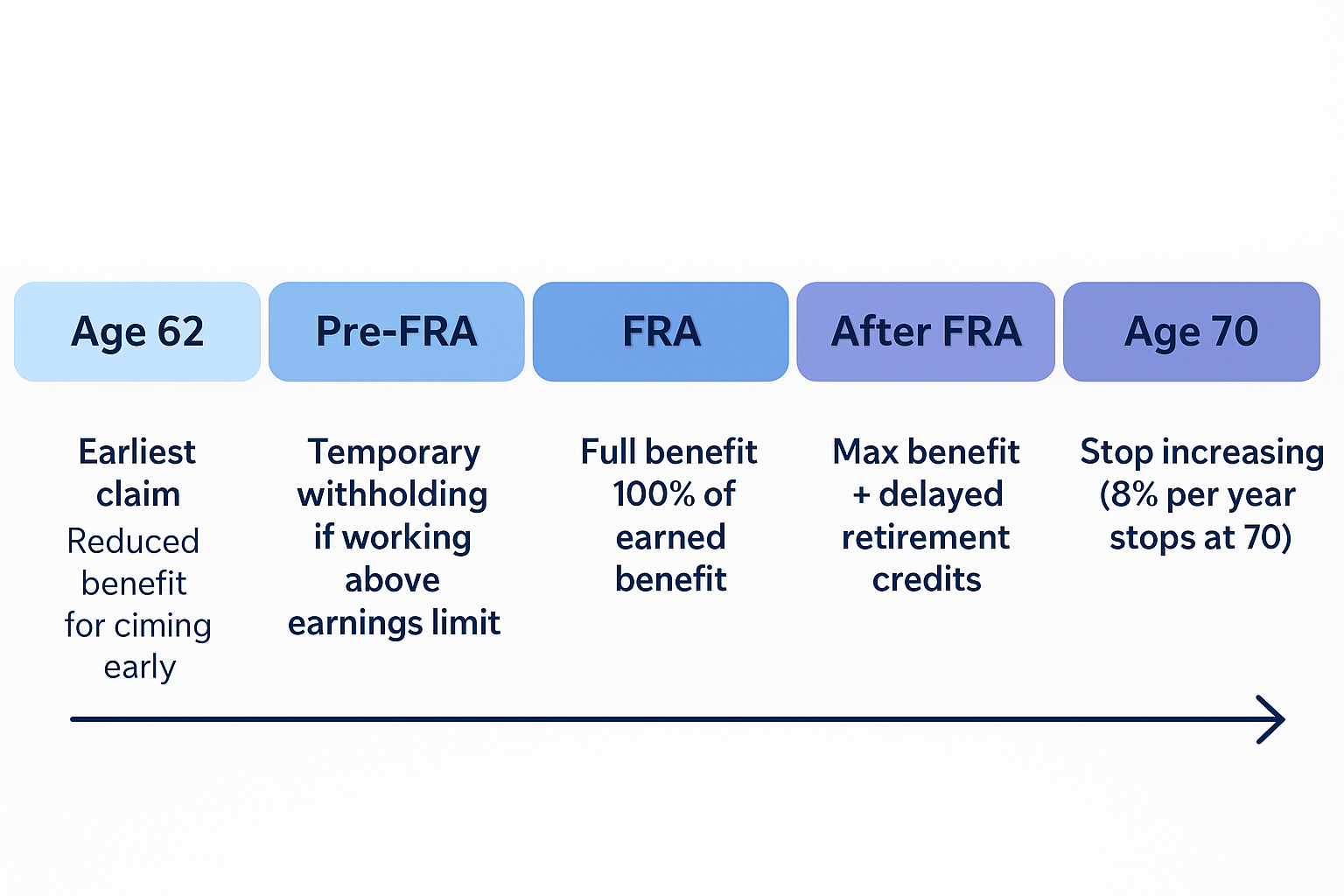

The age you apply for Social Security benefits affects your monthly benefit. Retire early, and your check is smaller because payments are spread over more years to keep the SS system sustainable. Wait past full retirement age, and you earn a “bonus” for waiting … an incentive to work longer.

Did You Know?

If you start collecting Social Security before full retirement age (66-67), and keep working, your benefits may be temporality reduced if you earn over the limit. Do not worry — once you hit full retirement age, your monthly benefit is usually recalculated in your favor. Just be sure to report your income so you do not miss out!

Remote Workers and Ex-Pats.

Working remotely or planning to retire and move outside the US? Your ability to receive Social Security benefits depends on the following:

US Citizens

If you are a US citizen, the good news is you can generally avoid double taxation from the US and the country where you work. Check with your tax professional for advice on your specific situation. Also, for the time being, when you retire you also receive your Social Security benefits no matter where you choose to live. However, it is always a good idea to check the Social Security Administration (SSA) website regarding totalization agreements/treaties and also the IRS for specific details about your chosen retirement country.

Non-US Citizens

If you are outside the US for over six (6) months, your Social Security benefits may be suspended. Exceptions exist for citizens of countries with a totalization agreement or treaty with the US so check if yours qualifies.

Show Me the Money!

Who can forget the classic 1996 movie Jerry Maguire? It gave us one of the most unforgettable lines in film history — Tom Cruise shouting, “Show me the money!” (Admit it, you just said it out loud.) Well, when it comes to Social Security benefits, the same rule applies — but instead of shouting into a phone, your earnings history does the talking. How much you will actually get depends on several key factors like your work record, when you start collecting, and how long you have been paying into the system.

Other factors can also affect your Social Security such as Medicare costs or even the types of jobs you have held over the years. We touch on both of these below:

How much could SS benefits be reduced by Medicare?

First, what is Medicare? Medicare is a health insurance program for people age 65 or older or those under 65 with certain disabilities and those with permanent kidney dialysis/kidney transplant. If you receive Medicare, the cost will be taken out of your monthly social security benefit, and the plan includes deductibles:

Premiums: The standard Medicare Part B monthly premium for 2025 is typically $185.00 and it is expected to increase at least $17 a month per year. If you are a higher earner (based upon your income two (2) years ago), your premium could be higher. For example, someone with a MAGI of $133,001-$167,000 may pay closer to $370.00 per month.

Your Job Could Impact your SS Benefits

If you were a government employee, served in the military, or performed railroad work, your income may be reported differently for Social Security purposes. Also, if you are working a side hustle, consulting, or doing farm work, it is crucial to report all your income. Why? Because Social Security benefits are based on the earnings you have reported and paid taxes on. If your income is not reported, you will not be paying into the government system, which could leave you with little to no benefits when you retire.

As Dolly Parton wisely said, “The way I see it, if you want the rainbow, you gotta put up with the rain.” So yes, it stinks that Social Security takes a chunk out of our paychecks — but the system was built as a safety net to protect Americans in retirement. Every choice you make today — when to start benefits, your earnings, and even gaps in your work history — shapes the income you’ll receive later.

“It is not our abilities that show who we really are …. It is our choices.”

~Harry Potter and Albus Dumbledore

You can even request a personalized estimate from the Social Security Administration here so you know where you stand.

Thinking about retirement and Social Security is also the perfect time to plan for life’s “what-ifs.” What if an accident left you unable to make decisions? Have you outlined your wishes for medical care, end-of-life choices, and your legacy? And if your parents are aging, it might also be time to think about how you will receive an inheritance without unintentionally creating tax issue, legal concerns, or untangling assets due to marital agreement. Schedule a consultation to see how your retirement goals fit into a complete estate plan.

If you are in need of assistance, the attorneys at Collins Family & Elder Law Group can help.